29+ Medicare Penalty Calculator

Is There a Medicare Part D Penalty Under 65. This amount 19788 is rounded to the nearest 10 and includes the.

Medicare Part D Penalty Calculator Neishloss Fleming

Web Medicare Part D.

. Since the monthly penalty is. Web Since the base Part B premium in 2023 is 16490 your monthly premium with the penalty will be 28033 16490 x 07 16490. Medicare Part D Late Enrollment Penalty.

Web An late enrollment penalty is charted by multiplying 1 out the national base beneficiary premium 3274 in 2020 times the number of all uncovered months which beneficiary. Youd have to pay a 1970 penalty on top of your premium each month in 2020. If you go more than 63 days without creditable drug coverage you may have to.

Web In 2023 the premium is either 278 or 506 each month 278 or 505 in 2024 depending on how long you or your spouse worked and paid Medicare taxes. Web Medicare Part A Hospital Insurance Costs Part A monthly premium Most people dont pay a Part A premium because they paid Medicare taxes while. 400 408 in 2024 copayment each day.

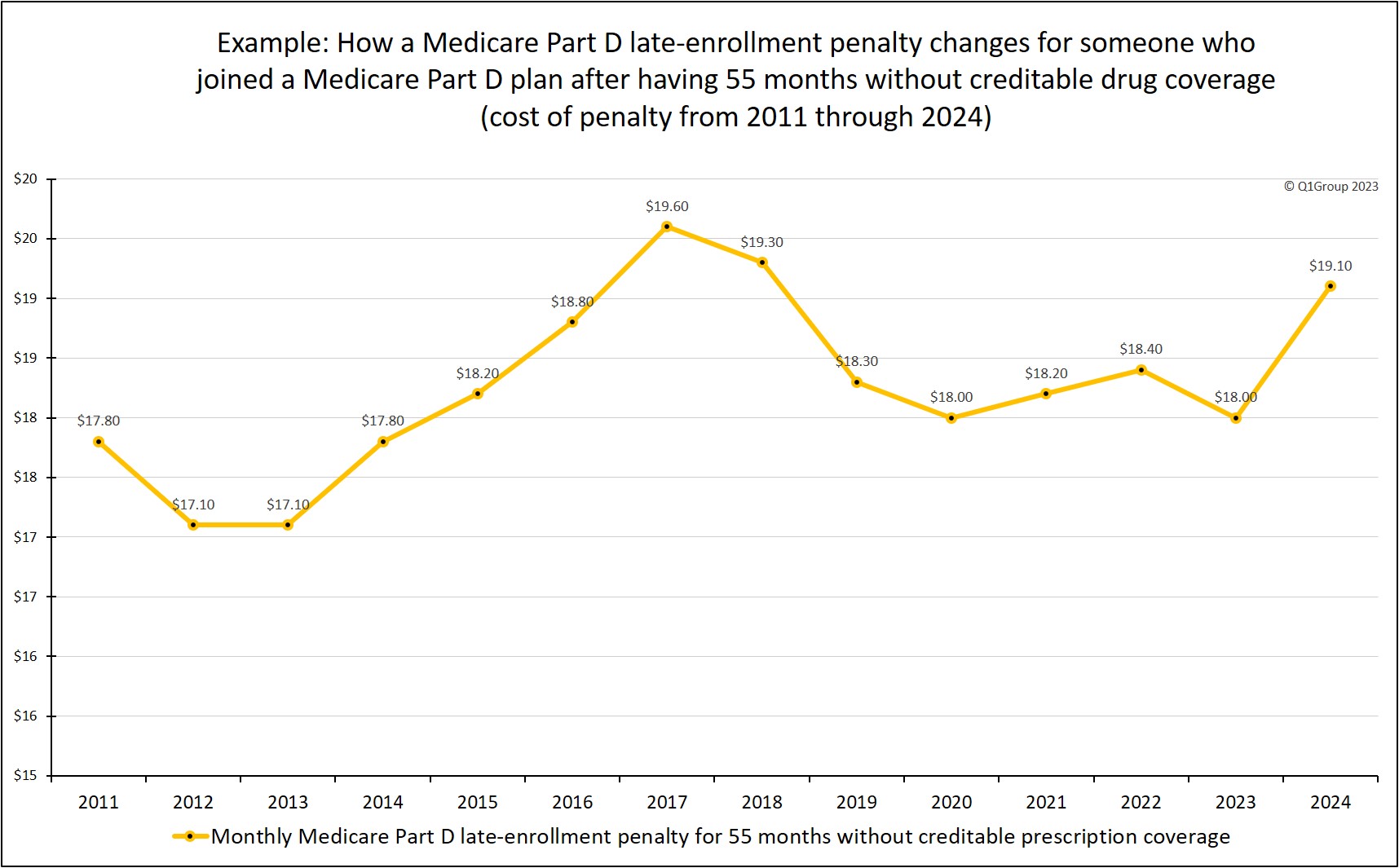

If you dont buy Part A when youre first eligible for Medicare usually when you turn 65 you might pay a penalty. Ad 10 Mistakes That Prospective Medicare Enrollees Make and How To Avoid Them. Web 2019December 2021 her penalty in 2022 was 29 1 for each of the 29 months of 3337 the base beneficiary premium for 2022 or 968.

Web Table of Contents. If income is greater than or equal to 397000. Web Use this calculator to determine your Component B penalty for going without admirable health insurance insurance for longer than 12 months.

Web Estimate my Medicare eligibility premium Get an estimate of when youre eligible for Medicare and your premium amount. Youll have to pay this additional cost each month for twice the number of years you were eligible for. Web The Part B penalty is calculated by taking 10 of the monthly Part B premium and multiplying it by the number of 12 months periods someone has gone without creditable.

Web 3298 20 of 16490 late enrollment penalty 19790 will be your Part B monthly premium for 2023. Web In most cases if you dont sign up for Medicare when youre first eligible you may have to pay a higher monthly premium. 3274 per month in 2023.

If your income is greater than 103000 and less than 397000 the IRMAA amount is 7420. The Medicare Part D late. Web For example if your open enrollment period ended on New Years Eve 2014 but you waited until mid-December 2019 to sign up for Part D heres how your penalty would be calculated for 2020 when the penalty was 3274 per month.

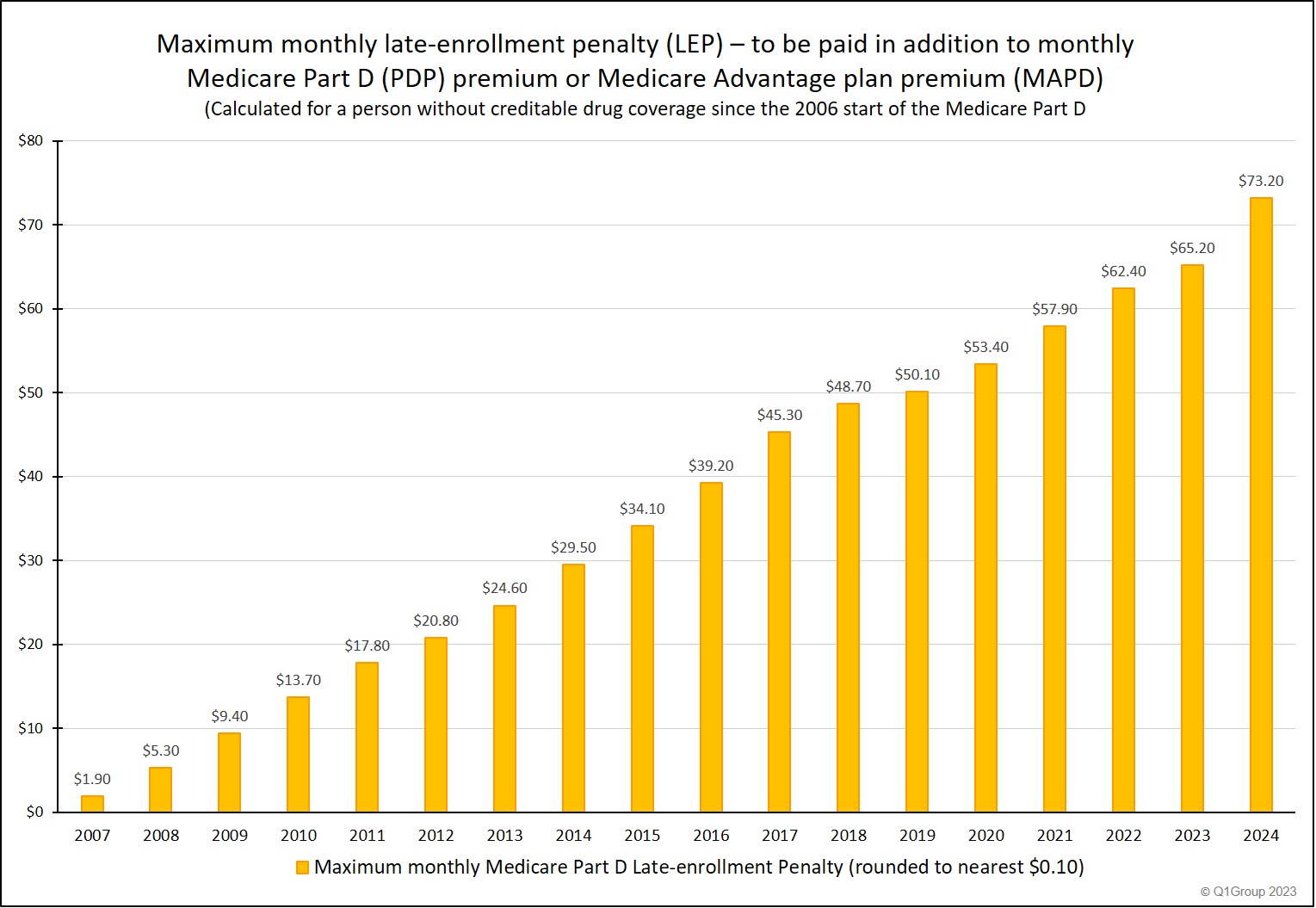

Web More than 71 million Americans will see a 32 increase in their Social Security benefits and Supplemental Security Income SSI payments in 2024. Web The penalty is calculated in part based on the national base beneficiary premium for Medicare Part D. What is the Medicare Part D Late Enrollment Penalty.

If you dont get premium-free Part A you pay up to 506 each month. Web Medicare calculates the penalty by multiplying 1 of the national base beneficiary premium 3274 in 2023 3470 in 2024 times the number of full uncovered months. Skip to content Available Mon.

Web Medicare Part D Penalty Calculator Please fill in the dates below to get an estimated penalty amount. More information on Medicare late enrollment penalties. If you dont see your situation contact Social.

Web The Medicare Part D late enrollment penalty adds 1 of the national base beneficiary premium 3274 per month in 2023 to your Medicare Part D premium for each full. Although your Part B premium amount. Web With this calculator you can enter your income age and family size to estimate your households individual mandate penalty any financial assistance you may qualify for.

You generally need to sign up for Medicare parts A and B during your initial enrollment period which begins. Web How is the Part B late enrollment penalty calculated. Web The late enrollment penalty amount is 10 percent of the cost of the monthly premium.

Web months 0 45 90 135 180 Estimated Monthly penalty for 2023 0 Will I have to pay a Part D Penalty. 800 816 in 2024 copayment each day while using your 60. Medicare Eligibility Date If your eligibility date is prior to June 2006 you.

If you dont buy Part A. When You Sign Up For Medicare You Have To Make Several Important Decisions.

Additional Reconciliation Run For Cms Py2020 Risk Adjustment Data Submission Allows More Time To Close Gaps And Increase Submission Accuracy

2017 Health Insurance Penalty Health For California

Mips 2023 Prepare Now To Avoid Financial Penalties Acep Now

Medicare Ehr Incentive Program The Gap Group

Pdf Sexual Dimorphism Of The Developing Human Brain Judith Rapoport Academia Edu

Making Sense Of The Medicare Advantage Payment Schedule

How Do I Calculate My Medicare Part D Late Enrollment Penalty

Eligibility Premium Calculator Medicare

Medicare Part D Penalty Calculator Neishloss Fleming

Use Our Medicare Part D Penalty Calculator To Estimate Your Penalty

Medicare Enrollment Date Calculator Boomer Benefits

How Do I Calculate My Medicare Part D Late Enrollment Penalty

Westside Messenger November 13th 2022

Use Our Medicare Part D Penalty Calculator To Estimate Your Penalty

Medicare Deadline Calculator Senior65

Medicare Final Rule For Fy 2023 Inpatient Rehabilitation Facility Prospective Payment System Berrydunn

Medicare Enrollment Date Calculator Boomer Benefits